How To Allow American Specific Card Payments In Quickbooks

Guarantee your QuickBooks software and service provider companies supplier are both PCI compliant. This minimizes risks associated to information breaches and keeps your customer’s information safe. QuickBooks provides rich analytical options that let you dive deep into customer demographics, frequency of purchases, and even preferences. Use these insights to tailor-make customer experiences, ensuring loyalty and repeat business. It’s additionally price exploring if your present service provider account can deal with American Express.

Step Three: Choose American Express As Your Bank

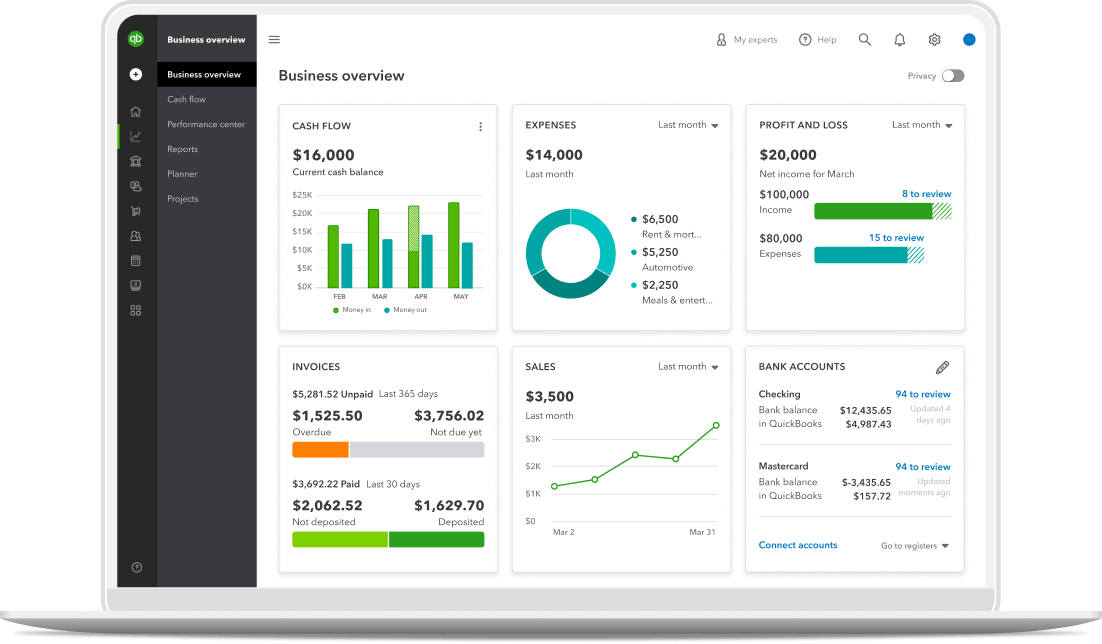

Such clear money circulate management ensures you keep tabs on invoices and expenses with none guide intervention. Seamless integration provides accuracy, effectivity, and peace of thoughts whereas dealing with payments. This integration streamlines the group and administration of economic data, providing complete insights into money circulate, earnings, and expenses. By sustaining correct and up-to-date knowledge, businesses can make knowledgeable choices, establish potential cost-saving opportunities, and improve monetary efficiency.

With American Express transactions within the combine, tracking gross sales and buyer data becomes even more essential. Leverage QuickBooks instruments just like the “Customer Insights” and “Sales Stories” to maintain monitor of who is buying what. Understanding this knowledge is essential to refining your advertising efforts and enhancing customer relationships. Optimize stock, streamline production workflows, and cut back errors with real-time information and mobile solutions, enhancing effectivity and boosting profitability. Straightforward to run solutions for retail and e-commerce companies, optimizing inventory administration, order success, and buyer experience, driving efficiency and profitability. To tackle duplicate entries, it’s necessary to reconcile the transactions in Quickbooks On-line and verify the settings for auto-import to stop duplications in the future.

Other AmountAutoPay will debit a onerous and fast quantity of your selection each month. Sure, you should have administrator or delegate access to the American Specific account to hyperlink it to QuickBooks On-line. You can routinely accept Visa, MasterCard, Uncover, and American Express.

The Means To Hyperlink Your American Enterprise Card And Checking To Quickbooks Online?

Establishing clear communication channels with the assist groups of both American Categorical and Quickbooks Online can streamline the resolution course of. Implementing proactive measures, corresponding to monitoring import logs and establishing https://www.quickbooks-payroll.org/ alerts for failed imports, can help in identifying and resolving points promptly. The accuracy of login info is significant for maintaining the integrity of monetary data, as any discrepancies can lead to errors in reporting and evaluation. Subsequently, it’s essential for users to double-check their login particulars to ensure a clean and accurate integration process. This real-time expense monitoring reduces the risk of errors and fraud, guaranteeing accurate financial information and compliance with rules. It additionally fosters better transparency and accountability inside the organization, ultimately leading to improved financial stability.

Staying knowledgeable ensures you are not caught off guard by changes, which might impact your margins. Keeping a detailed eye on these prices allows you to optimize your pricing technique successfully. The user-friendly interface makes it accessible for people with varying levels of monetary experience, further contributing to its effectivity and ease of use. Inside the ‘Account and Settings’ section, you can handle numerous features such as company info, billing & subscription, and related banks.

When you utilize the two together, you could earn a aggressive APY on funds deposited into your Enterprise Checking account. To keep your financials up-to-date, consider connecting your Business Checking with QuickBooks® On-line or Xero®. You also can connect to accounting software apps obtainable by way of Plaid® and Yodlee®, such as FreshBooks and Bench. Choose the quantity you’d wish to pay, your fee date, and make sure your one-time cost – you’re all set. You can arrange alerts that notify you when your assertion is prepared, when a payment is due, and when your cost has been obtained. If you do not have the Amex® App, you’ll have the ability to simply download it in the app store.

Accepting American Categorical funds can entail particular fees that differ from different card networks. Typically, American Express costs a barely greater service provider rate in comparison with different bank cards blue business. Having successfully set up American Specific funds, managing these transactions efficiently is the subsequent step.

This will streamline your monetary management, providing real-time insights and improving your general accounting efficiency. From the Banking tab, you can simply access the record of available banks and monetary institutions for seamless integration. Locate the option to add an account and select American Specific from the listing of supported banks. You will then be prompted to enter your American Categorical account login credentials to determine the connection. If you’re a delegate person (not the account holder) approved to hyperlink accounts in QuickBooks, guarantee you select the American Specific (Delegate) provider throughout setup.

- Make The Most Of analytics options within QuickBooks to gain insights and enhance your business strategy.

- You can evaluate, categorize, and match these transactions within the Transactions tab with out manually getting into information.

- If you don’t have the Amex® App, you can easily obtain it within the app store.

- QuickBooks Funds might have a slightly higher transaction fee for American Categorical compared to different playing cards.

From there, choose the ‘Connect Account’ possibility and select American Specific from the listing of economic institutions. All customers of our on-line services are topic to our Privateness Assertion and comply with be certain by the Terms of Service. Connecting Enterprise Checking to your external service provider processor is another method to streamline settlement processes.

Simplified Reconciliation Process

You could make changes to your settings as much as two days earlier than the scheduled debit date if you’d like them to take effect for the present statement period. Log into your account on-line or in your Amex® App and select the adjustments you’d wish to make. By following these steps and utilizing the advanced options, you can streamline your financial workflow, improve accuracy, and concentrate on growing your small business. I hope this info provides a transparent start line for bettering your expense management course of. If you want further clarification or help in implementing these options, please do not hesitate to succeed in out.